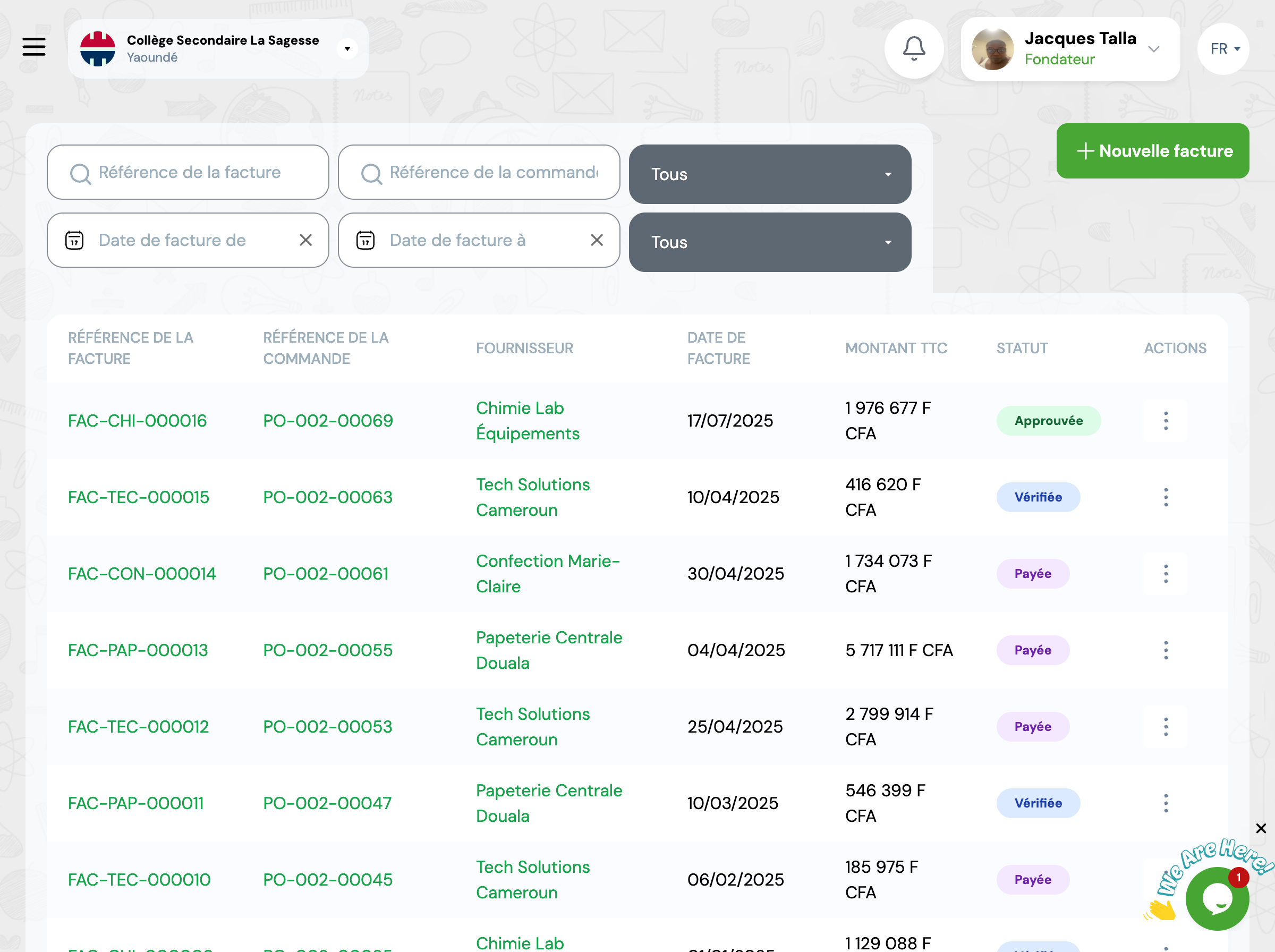

Supplier Invoices

Manage the complete invoice lifecycle from reception to payment with approval workflows

Table of Contents

1 What is a supplier invoice?

A supplier invoice is the official document sent by your supplier after delivery of ordered items. It details delivered items, quantities, prices, and total amount to pay. GO4STOCK allows managing the complete invoice cycle with approval workflow.

2 Invoice lifecycle

Invoice workflow

Invoice has been recorded in system (manually or automatically from purchase order)

Responsable : Stock manager or accountant

First level of control validated that invoice matches delivery and quantities received

Responsable : Purchasing manager

Invoice has been approved and can be paid. It's transmitted to accounting department for payment

Responsable : Director or financial manager

Invoice was refused due to non-conformity (price error, incorrect quantities, etc.)

Responsable : N/A - Contact supplier

Payment has been made. Invoice is archived

Responsable : Accountant

3 Create an invoice

Recommended From purchase order

Recommended method: during delivery reception, system can automatically generate pre-filled invoice

Access delivered purchase order

Click 'Create invoice'

System automatically pre-fills all fields (items, quantities, prices)

Add supplier invoice number and reception date

Save

Manually

If invoice is not linked to existing purchase order

Go to GO4STOCK > Invoices

Click 'New invoice'

Select supplier

Add invoiced items with quantities and unit prices

Fill in supplier invoice number and date

Save

4 Verify an invoice

Verification consists of checking that invoice matches delivery actually received

Points to verify

Invoiced items match delivered items

Invoiced quantities match received quantities

Unit prices match purchase order

Total amount is correct

Invoice number and date are correct

Supplier information is accurate

How to verify

1. Open invoice in 'Created' status

2. Compare with delivery note and purchase order

3. If everything conforms, click 'Verify'

4. If you detect error, modify or reject invoice with explanatory comment

5 Approve an invoice

Approval is final validation before payment. It's generally reserved for managers or directors

Approval criteria

✓ Invoice has already been verified

✓ Budget is available for this payment

✓ Supplier is in good standing

✓ No ongoing dispute with this supplier

How to approve

1. Open invoice in 'Verified' status

2. Check amount and supplier

3. Click 'Approve'

4. Invoice changes to 'Approved' status and can be paid

6 Reject an invoice

You can reject an invoice anytime if you detect anomaly

Common reasons for rejection

Prices different from those agreed

Invoiced quantities higher than delivered quantities

Items not ordered or not delivered

Calculation errors on total

Missing or incorrect information

How to reject

1. Open invoice

2. Click 'Reject'

3. Mandatory add comment explaining rejection reason

4. Contact supplier to get corrected invoice

7 Mark as paid

Once payment made by accounting department, mark invoice as paid in GO4STOCK

How to mark as paid

Open invoice in 'Approved' status

Click 'Mark as paid'

Indicate payment date and payment method (transfer, check, cash, etc.)

Add payment reference (check number, transfer reference, etc.)

Save

⚠️ Important : Once marked as paid, invoice can no longer be modified. It's permanently archived.

8 Best practices

Create invoices upon receipt

Don't wait! Record each invoice as soon as you receive it to avoid oversights and facilitate tracking.

Attach PDF file of invoice

Scan or download PDF file of original invoice and attach it to invoice record in GO4STOCK.

Systematically verify

Never go directly from 'Created' to 'Approved'. Respect complete workflow to avoid errors.

Document rejections

When rejecting invoice, be precise in your comments to facilitate supplier correction.

Follow payment deadlines

Respect payment terms negotiated with your suppliers (30 days, 60 days, etc.) to maintain good relations.

Archive supporting documents

Keep all related documents (invoice, delivery note, purchase order) for at least 5 years for audits.

9 Frequently asked questions

Can I modify an already approved invoice?

No, an approved invoice can no longer be modified. If you detect error, you must: 1) Reject it with explanatory comment, 2) Create new corrected invoice. This rule ensures traceability and integrity of approval process.

What if invoice doesn't match purchase order?

If invoice differs from purchase order (prices, quantities), you have two options: 1) If discrepancy is minor and justified, you can accept it and explain in notes, 2) If discrepancy is significant, reject invoice and contact supplier to get conforming invoice.

How to handle partial invoices?

If purchase order is delivered in multiple times, create separate invoice for each delivery. Each invoice will correspond to part of purchase order. System keeps track of all invoices linked to same purchase order.

Who can approve invoices?

Permissions are defined by role. Generally: stock managers can create and verify, purchasing managers can approve up to certain amount, directors approve high amounts. Consult your administrator to know your permissions.

Can I cancel a payment?

No, once invoice is marked as 'Paid', it can no longer be modified. If refund is necessary, create separate credit note invoice (negative amount) to cancel initial transaction.

How to search for old invoice?

Use filters on invoices page: by supplier, by status, by period, by invoice number or by associated purchase order. You can also search by amount or reference.